-

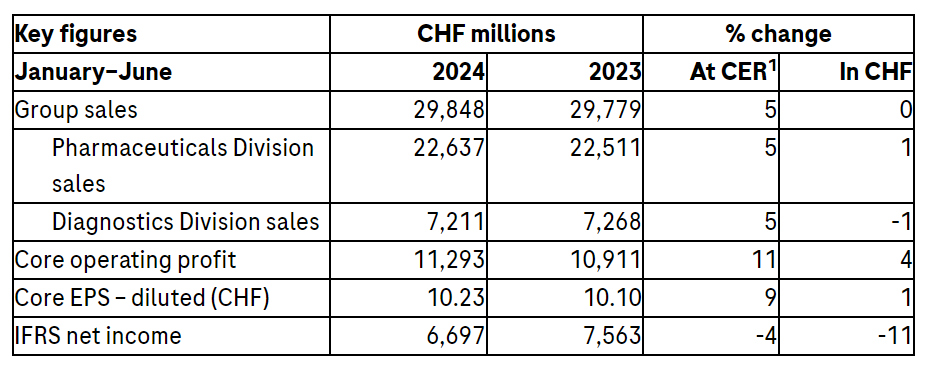

Group sales were up by 5%1 at constant exchange rates (CER) (stable in CHF) in the first half, driven by the high demand for both our medicines and diagnostics; excluding COVID-19-related products, sales increased by 8%

-

Group sales growth accelerated to 9% (7% in CHF) in the second quarter as the decline in COVID-19-related sales no longer had an impact on overall sales

-

Pharmaceuticals Division sales rose by 5% in the first half; strong growth of 8% in the base business2 excluding COVID-19 effect was driven by continued high demand for our newer medicines to treat severe diseases; eye medicine Vabysmo was again the major growth driver

-

Diagnostics Division sales rose by 5%, while growth in the base business2, which excludes the impact of COVID-19 sales, was 9% due to higher demand for immunodiagnostic products

-

Core operating profit increased by 11% (4% in CHF), core earnings per share grew by 9% (1% in CHF) and IFRS net income was down by 4%

-

Outlook for 2024 earnings raised

Highlights:

-

US approval for Vabysmo prefilled syringe for three leading causes of vision loss and PiaSky for a rare blood condition; US filing acceptance for Susvimo in two leading causes of vision loss in adults with diabetes

-

US FDA Breakthrough Therapy Designation, priority review and filing acceptance for inavolisib (breast cancer); US FDA Breakthrough Therapy Designation for Columvi (blood cancer)

-

EU approval for Ocrevus subcutaneous injection (multiple sclerosis) and Alecensa (early-stage lung cancer); positive EU opinion for Vabysmo (retinal vein occlusion, a severe eye disease) and PiaSky in paroxysmal nocturnal haemoglobinuria (PNH), a rare blood condition; EU marketing authorisation application review initiated for Elevidys (Duchenne muscular dystrophy)

-

Positive phase III data for Columvi (blood cancer), five-year data for Evrysdi (spinal muscular atrophy), four-year data for Vabysmo (DME, a severe eye disease), phase Ib data for CT-388 (obesity) and phase I data for CT-996 (obesity)

-

CE mark for Accu-Chek SmartGuide, an AI-enabled continuous glucose monitoring solution offering critical predictions to people living with diabetes

-

US approval of human papillomavirus (HPV) self-collection solution, the first available in the country to allow women to privately collect their samples; two new WHO prequalifications for cervical cancer screening tools, including HPV self-collection solution

-

Launch of new analytical units, cobas c 703 and cobas ISE neo, to deliver higher testing capacity and increased automation for laboratories

-

US emergency use authorisation for cobas liat four-in-one molecular test for some of the most prevalent respiratory viruses

Roche CEO Thomas Schinecker: “Our strong sales growth in the first half of 2024 reflects the high demand for our innovative medicines and diagnostics. In the second quarter, we saw an acceleration of our growth momentum as Group sales were no longer impacted by the decline in COVID-19 sales, resulting in very strong sales growth for the Group. Based on our strong half-year results, we are raising our earnings outlook for the full year.

We also received a number of important regulatory approvals in the last three months, including EU approval for Alecensa for a form of early-stage lung cancer, as well as for the subcutaneous injection of Ocrevus, which provides an additional treatment option for multiple sclerosis. I am particularly pleased about the US approval for the ready-to-use prefilled syringe of our eye medicine Vabysmo, which continues to be our main growth driver. In diagnostics, our new Accu-Chek SmartGuide solution for continuous blood glucose monitoring uses artificial intelligence to provide reliable blood glucose level forecasts for several hours.”

Outlook for 2024 earnings raised

Roche expects an increase in Group sales in the mid single digit range (CER).

Core earnings per share are targeted to grow in the high single digit range (CER), excluding the impact from the resolution of tax disputes in 2023.

Roche expects to further increase its dividend in Swiss francs.

Group results

In the first half of 2024, Group sales were up by 5% at CER (stable in CHF) at CHF 29.8 billion. While the appreciation of the Swiss franc slowed against most currencies, it had an adverse impact on the results presented in Swiss francs compared to constant exchange rates.

Core operating profit grew by 11% (4% in CHF), driven by higher sales and cost management.

Core earnings per share increased by 9% (1% in CHF). IFRS net income was 4% lower (-11% in CHF), mainly due to the impairment of product and technology intangible assets in the research or development phase following strategic decisions. In addition, the IFRS result was impacted by the base effect of the release of provisions related to litigations in the first half of 2023.

The Pharmaceuticals Division base business grew by 8%, while divisional sales increased by 5% to CHF 22.6 billion, driven primarily by higher sales of Vabysmo (severe eye diseases), with growing demand for Phesgo (breast cancer), Ocrevus (multiple sclerosis), Polivy (blood cancer) and Evrysdi (spinal muscular atrophy). These five medicines together generated total sales of CHF 7.3 billion, an increase of CHF 1.8 billion (CER) from the first half of 2023.

The eye medicine Vabysmo, launched in early 2022, remained a major growth driver, generating sales of CHF 1.8 billion on growing demand in all regions, mainly the US.

Sales of MabThera/Rituxan, Herceptin and Avastin decreased by a combined CHF 0.4 billion (CER) as the impact of biosimilar competition slowed further. Sales of the COVID-19 medicine Ronapreve were minimal compared with CHF 0.5 billion in the first half of 2023.

In the United States, sales grew by 5% as increased sales of Vabysmo, Polivy, Ocrevus and Xolair (food allergies) were partially offset by the continued decline in sales of medicines for which patent protection has expired. Vabysmo achieved CHF 1.4 billion in sales, showing a high uptake in both new patients and patients switching from other medications.

In Europe, sales surged by 10%, driven by demand for Vabysmo in France, the UK and Germany as well as by the continued uptake of Phesgo, Ocrevus, Hemlibra (haemophilia) and Evrysdi. This was partially offset by lower sales of medicines for which patent protection has expired and of Perjeta (breast cancer) due to ongoing conversion of patients to Phesgo.

Sales in Japan were down 28%, mainly due to the base effect of the supply of Ronapreve (COVID-19) to the government in the first half of 2023. Excluding this effect, sales in Japan were 5% lower as strong demand for Phesgo was more than offset by the impact of government price cuts.

Sales in the International region increased by 17%, led by demand for Perjeta, Evrysdi, Phesgo and Tecentriq (cancer immunotherapy). Sales in China increased by 14%, driven by Perjeta, Alecensa (lung cancer), Avastin (liver cancer), Xofluza (influenza) and Polivy.

The Diagnostics Division base business grew by 9%, while divisional sales increased by 5% to CHF 7.2 billion. Immunodiagnostic products, which include cardiac, oncology and thyroid tests, were the main growth drivers (11%). Additional growth impetus came from clinical chemistry (8%), advanced staining techniques in oncology (11%) and from companion diagnostics (46%).

The continued good growth in the division’s base business was partially offset by the expected sales decline of COVID-19-related products. Sales of COVID-19 tests further declined to CHF 0.1 billion in the first half of 2024 from CHF 0.4 billion in the corresponding period last year.

Sales growth was reported across all regions, with the Europe, Middle East and Africa (EMEA) region growing by 4%, North America by 5%, Asia-Pacific by 3% and Latin America by 16%.

About Roche

Founded in 1896 in Basel, Switzerland, as one of the first industrial manufacturers of branded medicines, Roche has grown into the world’s largest biotechnology company and the global leader in in vitro diagnostics. The company pursues scientific excellence to discover and develop medicines and diagnostics for improving and saving the lives of people around the world. We are a pioneer in personalised healthcare and want to further transform how healthcare is delivered to have an even greater impact. To provide the best care for each person we partner with many stakeholders and combine our strengths in Diagnostics and Pharma with data insights from the clinical practice.

In recognising our endeavour to pursue a long-term perspective in all we do, Roche has been named one of the most sustainable companies in the pharmaceuticals industry by the Dow Jones Sustainability Indices for the fifteenth consecutive year. This distinction also reflects our efforts to improve access to healthcare together with local partners in every country we work.

Genentech, in the United States, is a wholly owned member of the Roche Group. Roche is the majority shareholder in Chugai Pharmaceutical, Japan.

References

[1] Unless otherwise stated, all growth rates and comparisons to the previous year in this document are at constant exchange rates (CER: average rates 2023) and all total figures quoted are reported in CHF.

[2] Pharmaceuticals Division base business: excluding COVID-19 medicine Ronapreve.

Diagnostics Division base business: excluding COVID-19-related products.

[3] Products launched before 2015.

[4] Core Lab: diagnostics solutions in the areas of immunoassays, clinical chemistry and CustomBiotech.

Molecular Lab: diagnostics solutions for pathogen detection and monitoring, donor screening, sexual health and genomics, genomic tumour profiling.

Near Patient Care: diagnostics solutions in emergency rooms, medical practices and directly with patients, including integrated personalised diabetes management.

Pathology Lab: diagnostics solutions for tissue biopsies and companion diagnostics.

[5] Sales in the Molecular Lab customer area include sales from the Foundation Medicine business which moved under the responsibility of the Diagnostics Division from the Pharmaceuticals Division effective 1 January 2024. The comparative information for 2023 has been restated accordingly.

[6] Sales in the new Near Patient Care customer area include sales from Diabetes Care and the Point of Care business, both previously shown as separate customer areas. The comparative information for 2023 has been restated accordingly.