Total Worldwide Sales Were $16.7 Billion, an Increase of 4% From Third Quarter 2023; Excluding the Impact of Foreign Exchange, Growth Was 7%

KEYTRUDA Sales Grew 17% to $7.4 Billion; Excluding the Impact of Foreign Exchange, Sales Grew 21%

WINREVAIR Sales Were $149 Million; U.S. Launch of WINREVAIR Gaining Momentum; Received Approval in the EU

Animal Health Sales Grew 6% to $1.5 Billion; Excluding the Impact of Foreign Exchange, Sales Grew 11%

GAAP EPS Was $1.24; Non-GAAP EPS Was $1.57; GAAP and Non-GAAP EPS Include a Net Charge of $0.79 per Share Related to Certain Business Development Transactions

Achieved Significant Milestones in Vaccine Programs

CAPVAXIVE Recommended by the CDC’s ACIP for Pneumococcal Vaccination in Adults 50 Years of Age and Older

Presented Positive Results From Clinical Studies Evaluating Clesrovimab (MK-1654), an Investigational RSV Preventative Monoclonal Antibody for Infants Entering Their First RSV Season

Data Presented for Four Approved Medicines and Six Pipeline Candidates in More Than 20 Types of Cancer at ESMO Congress 2024, Including Overall Survival Data From KEYNOTE-522 and KEYNOTE-A18

Completed Acquisition of Investigational B-Cell Depletion Therapy, CN201 (MK-1045), From Curon Biopharmaceutical

Full-Year 2024 Financial Outlook

Narrows Expected Worldwide Sales Range To Be Between $63.6 Billion and $64.1 Billion

Now Expects Non-GAAP EPS To Be Between $7.72 and $7.77; Outlook Reflects a Net Negative Impact of $0.24 per Share Related to Business Development Transactions With Curon Biopharmaceutical and Daiichi Sankyo

October 31, 2024 6:30 am ET--RAHWAY, N.J.--(BUSINESS WIRE)-- Merck (NYSE: MRK), known as MSD outside the United States and Canada, today announced financial results for the third quarter of 2024.

“Our third-quarter results were strong, as we continue to make progress heading into 2025 and beyond," said Robert M. Davis, chairman and chief executive officer, Merck. "Our pipeline is advancing and expanding, demonstrating our success in creating a sustainable innovation engine, and positioning Merck with a more diversified portfolio to drive growth. I continue to remain confident in the strength of our business and our ability to execute, and I want to thank our colleagues across the globe for their focus and commitment as we work to create lasting value for patients, shareholders and all our stakeholders.”

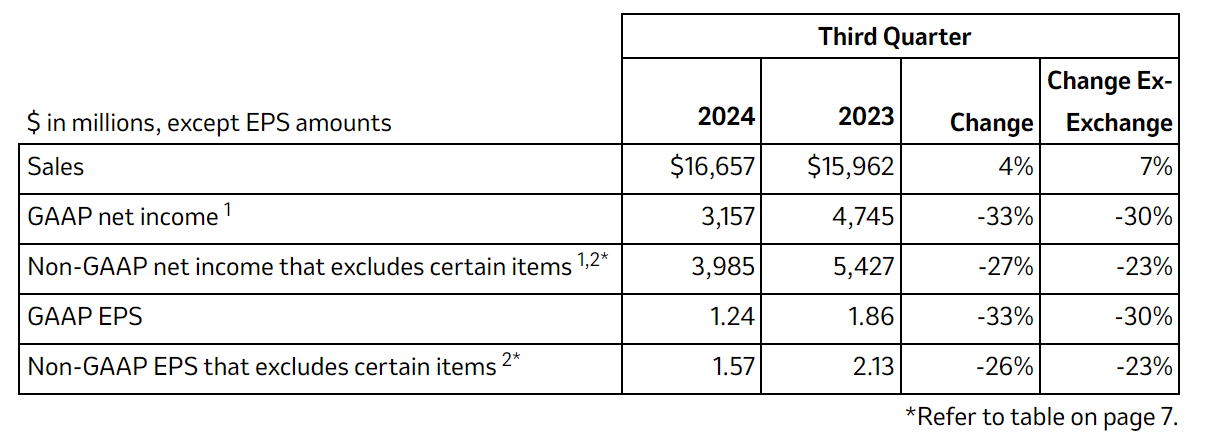

Financial Summary

In the third quarter of 2024, total worldwide sales were $16.7 billion, an increase of 4% compared with the third quarter of 2023; excluding the impact of foreign exchange, growth was 7%. Sales growth in the third quarter of 2024 was primarily due to increased usage of KEYTRUDA globally, contributions from new launches, including WINREVAIR and CAPVAXIVE, and strong growth in Merck’s Animal Health business. Revenue growth in the third quarter of 2024 was partially offset by lower sales of JANUVIA and JANUMET, lower combined sales of GARDASIL/GARDASIL 9 and lower sales of LAGEVRIO. Third-quarter GARDASIL/GARDASIL 9 sales declined year-over-year due to reduced demand in China; outside of China, the company achieved double-digit sales growth for GARDASIL/GARDASIL 9 in almost every major region globally.

For the third quarter of 2024, Generally Accepted Accounting Principles (GAAP) earnings per share (EPS) assuming dilution was $1.24 and non-GAAP EPS was $1.57. The declines in GAAP and Non-GAAP EPS in the third quarter of 2024 versus the prior year were largely due to a net charge of $0.79 per share in the aggregate for the acquisition of Eyebiotech Limited (EyeBio) and a related development milestone, the acquisition of CN201 (now known as MK-1045) from Curon Biopharmaceutical (Curon), as well as a payment received from Daiichi Sankyo related to the expansion of the existing development and commercialization agreement. There were no significant business development transaction charges in the third quarter of 2023.

Non-GAAP EPS in both periods excludes acquisition- and divestiture-related costs, costs related to restructuring programs, as well as income and losses from investments in equity securities.

Year-to-date results can be found in the attached tables.

Earnings Conference Call

Investors, journalists and the general public may access a live audio webcast of the earnings conference call on Thursday, October 31, at 9 a.m. ET via this weblink. A replay of the webcast, along with the sales and earnings news release, supplemental financial disclosures, and slides highlighting the results, will be available at www.merck.com.

All participants may join the call by dialing (800) 369-3351 (U.S. and Canada Toll-Free) or (517) 308-9448 and using the access code 9818590.

About Merck

At Merck, known as MSD outside of the United States and Canada, we are unified around our purpose: We use the power of leading-edge science to save and improve lives around the world. For more than 130 years, we have brought hope to humanity through the development of important medicines and vaccines. We aspire to be the premier research-intensive biopharmaceutical company in the world – and today, we are at the forefront of research to deliver innovative health solutions that advance the prevention and treatment of diseases in people and animals. We foster a diverse and inclusive global workforce and operate responsibly every day to enable a safe, sustainable and healthy future for all people and communities. For more information, visit www.merck.com and connect with us on X (formerly Twitter), Facebook, Instagram, YouTube and LinkedIn.

1.Net income attributable to Merck & Co., Inc.

2.Merck is providing certain 2024 and 2023 non-GAAP information that excludes certain items because of the nature of these items and the impact they have on the analysis of underlying business performance and trends. Management believes that providing this information enhances investors’ understanding of the company’s results because management uses non-GAAP results to assess performance. Management uses non-GAAP measures internally for planning and forecasting purposes and to measure the performance of the company along with other metrics. In addition, annual employee compensation, including senior management’s compensation, is derived in part using a non-GAAP pretax income metric. This information should be considered in addition to, but not as a substitute for or superior to, information prepared in accordance with GAAP. For a description of the non-GAAP adjustments, see Table 2a attached to this release.

3.Reflects expenses related to acquisitions of businesses, including the amortization of intangible assets, intangible asset impairment charges and expense or income related to changes in the estimated fair value measurement of liabilities for contingent consideration. Also includes integration, transaction and certain other costs associated with acquisitions and divestitures, as well as amortization of intangible assets related to collaborations and licensing arrangements.