Revenue in Q1 2025 increased 45% to $12.73 billion driven by volume growth from Mounjaro and Zepbound.

Pipeline progress included positive Phase 3 trial results for orforglipron (small molecule oral GLP-1 agonist) in Type 2 diabetes in the first of seven obesity and diabetes Phase 3 trials.

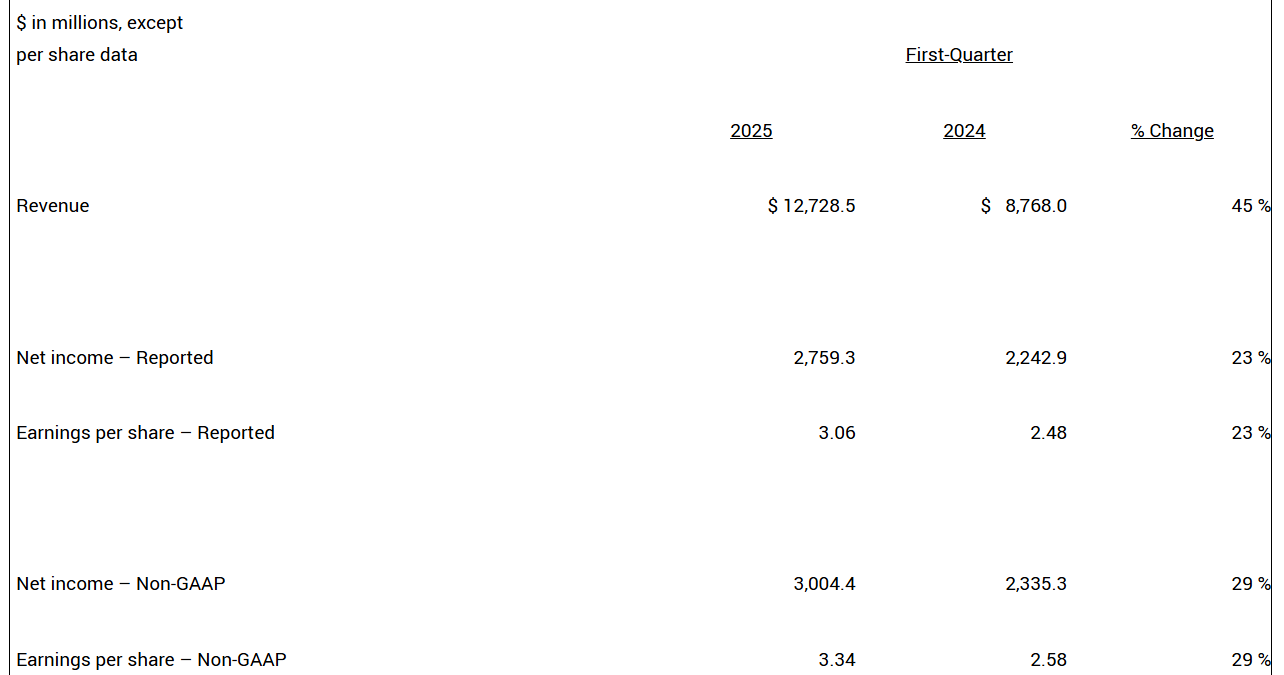

Q1 2025 EPS increased 23% to $3.06 on a reported basis and increased 29% to $3.34 on a non-GAAP basis, both inclusive of $1.72 of acquired IPR&D charges.

Revenue guidance reaffirmed to be between $58.0 billion and $61.0 billion.

INDIANAPOLIS, May 1, 2025 /PRNewswire/ -- Eli Lilly and Company (NYSE: LLY) today announced its financial results for the first-quarter of 2025.

"Lilly had a solid start to the year, with 45% year-over-year revenue growth driven by strong sales of Mounjaro and Zepbound," said David A. Ricks, Lilly chair and CEO. "Our pipeline continued to deliver across key therapeutic areas, with product approvals in oncology and immunology, and the exciting success of our oral incretin, orforglipron, in the first of seven late-stage studies in diabetes and obesity. To support global demand for our newest medicines, we're accelerating our manufacturing investments, as underscored by our recent announcement to build four new facilities."

Financial Results

A discussion of the non-GAAP financial measures is included below under "Reconciliation of GAAP Reported to Selected Non-GAAP Adjusted Information (Unaudited)."

First-Quarter Reported Results

In Q1 2025, worldwide revenue was $12.73 billion, an increase of 45% compared with Q1 2024, driven by a 53% increase in volume, partially offset by a 6% decrease due to lower realized prices and a 2% unfavorable impact of foreign exchange rates. Key Products1 revenue grew by $4.09 billion to $7.52 billion in Q1 2025, led by Mounjaro and Zepbound.

Revenue in the U.S. increased 49% to $8.49 billion, driven by a 57% increase in volume, partially offset by a 7% decrease due to lower realized prices. The increase in U.S. volume was driven by Zepbound and Mounjaro.

Revenue outside the U.S. increased 38% to $4.24 billion, driven by a 46% increase in volume. The volume increase outside the U.S. was driven primarily by Mounjaro and, to a lesser extent, Jardiance. Jardiance revenue included a one-time benefit of $370.0 million associated with an amendment to the company's collaboration with Boehringer Ingelheim. Pursuant to the amendment, we and Boehringer Ingelheim adjusted commercialization responsibilities for Jardiance within certain markets.

Gross margin increased 48% to $10.50 billion in Q1 2025. Gross margin as a percent of revenue was 82.5%, an increase of 1.6 percentage points. The increase in gross margin percent was primarily driven by improved cost of production and favorable product mix, partially offset by lower realized prices.

In Q1 2025, research and development expenses increased 8% to $2.73 billion, or 21.5% of revenue, driven by continued investments in the company's early and late-stage portfolio.

Marketing, selling and administrative expenses increased 26% to $2.47 billion in Q1 2025, primarily driven by promotional efforts supporting ongoing and future launches.

In Q1 2025, the company recognized acquired in-process research and development (IPR&D) charges of $1.57 billion compared with $110.5 million in Q1 2024. The Q1 2025 charges primarily related to the acquisition of Scorpion Therapeutics, Inc.'s PI3Kα inhibitor program STX-478.

The effective tax rate was 20.2% in Q1 2025 compared with 11.6% in Q1 2024, primarily driven by the unfavorable tax impact of a non-deductible acquired IPR&D charge in Q1 2025. The 2025 and 2024 effective tax rates were impacted by discrete tax benefits in each period.

In Q1 2025, net income and earnings per share (EPS) were $2.76 billion and $3.06, respectively, compared with net income of $2.24 billion and EPS of $2.48 in Q1 2024. EPS in Q1 2025 and Q1 2024 included acquired IPR&D charges of $1.72 and $0.10, respectively.

__________________________________

1 The Company defines Key Products as Ebglyss, Jaypirca, Kisunla, Mounjaro, Omvoh, Verzenio, and Zepbound.

Non-GAAP Financial Measures

Certain financial information is presented on both a reported and a non-GAAP basis. Some numbers in this press release may not add due to rounding. Reported results were prepared in accordance with U.S. generally accepted accounting principles (GAAP) and include all revenue and expenses recognized during the periods. Non-GAAP measures reflect adjustments for the items described in the reconciliation tables later in the release. Related materials provide certain GAAP and non-GAAP figures excluding the impact of foreign exchange rates. Lilly recalculates current period figures on a constant currency basis by keeping constant the exchange rates from the base period. The company's 2025 financial guidance is provided on both a reported and a non-GAAP basis. The non-GAAP measures are presented to provide additional insights into the underlying trends in the company's business.

About Lilly

Lilly is a medicine company turning science into healing to make life better for people around the world. We've been pioneering life-changing discoveries for nearly 150 years, and today our medicines help tens of millions of people across the globe. Harnessing the power of biotechnology, chemistry and genetic medicine, our scientists are urgently advancing new discoveries to solve some of the world's most significant health challenges: redefining diabetes care; treating obesity and curtailing its most devastating long-term effects; advancing the fight against Alzheimer's disease; providing solutions to some of the most debilitating immune system disorders; and transforming the most difficult-to-treat cancers into manageable diseases. With each step toward a healthier world, we're motivated by one thing: making life better for millions more people. That includes delivering innovative clinical trials that reflect the diversity of our world and working to ensure our medicines are accessible and affordable.