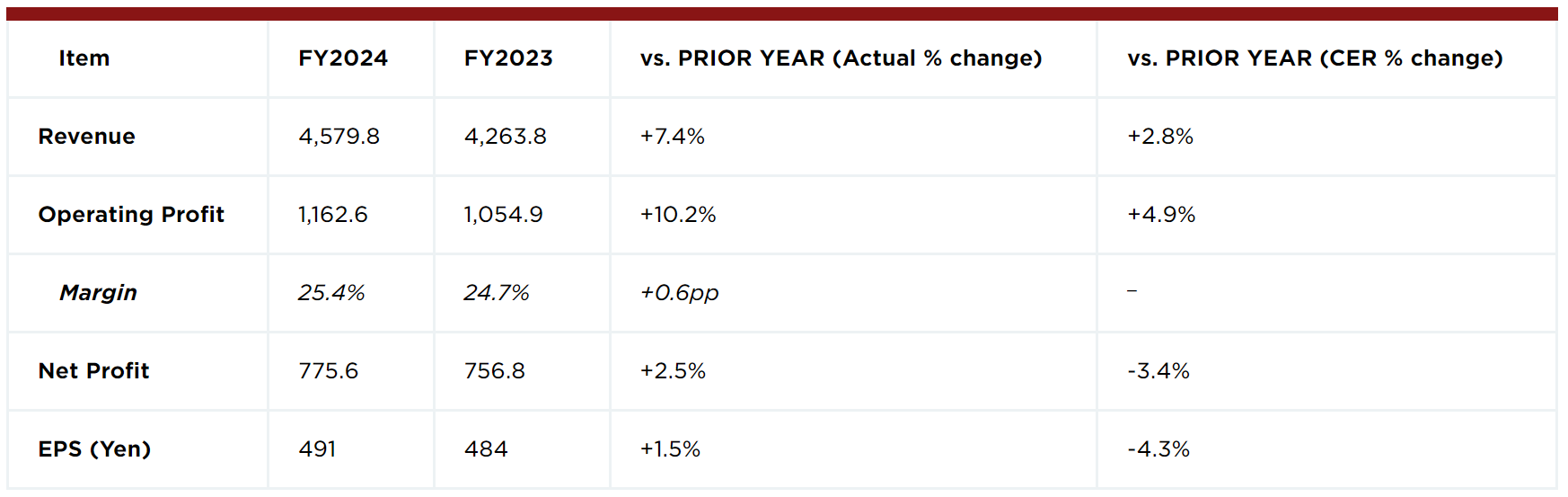

Core Revenue Growth of 7.4% at Actual Exchange Rates (AER), + 2.8% at Constant Exchange Rate (CER) in FY2024

Core Operating Profit Growth of 4.9% at CER with Efficiency Program Driving Cost Savings

Up to Six New Molecular Entities in Phase 3 Development in FY2025 with Three Phase 3 Data Readouts Recently Completed or Anticipated

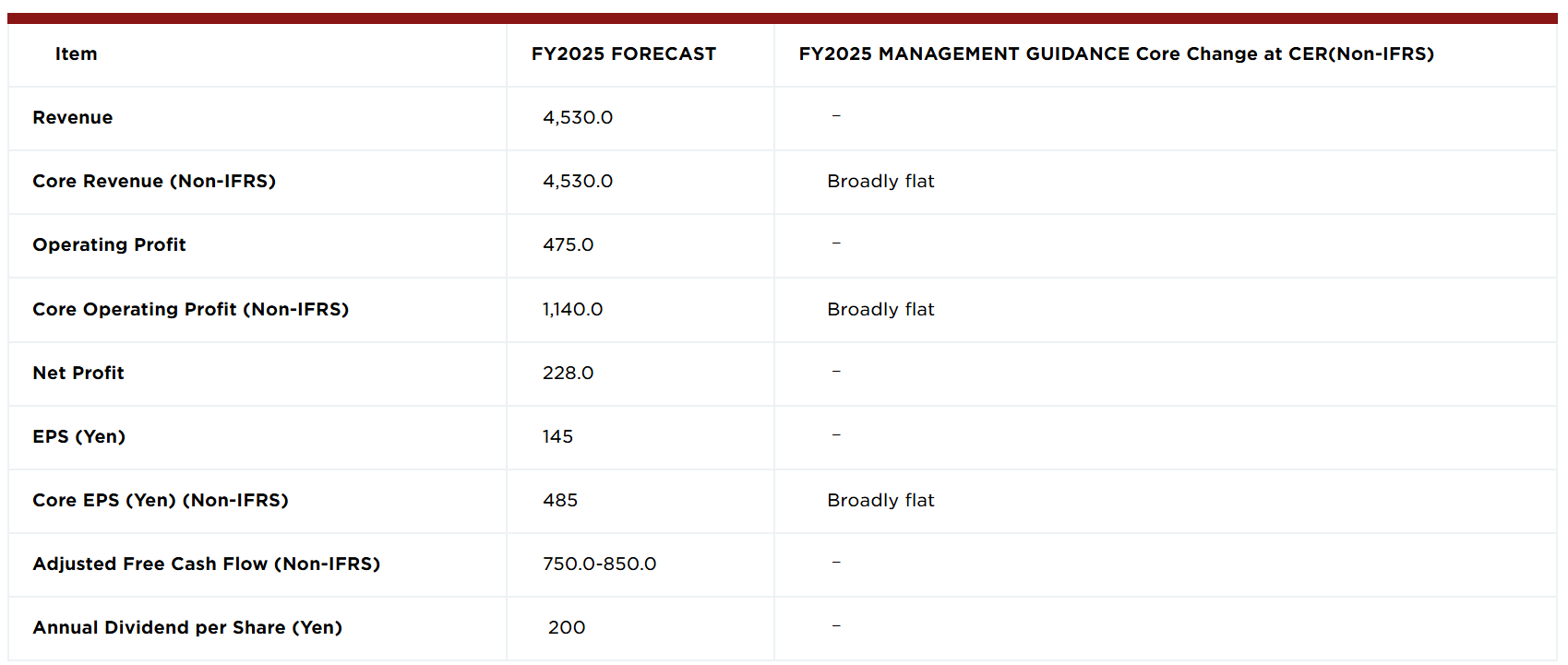

FY2025 Outlook for Broadly Flat Revenue and Core Profit Reflecting Product Momentum and Increasing Investment in New Launch Preparation

Proposed Dividend Increase from JPY 196 to JPY 200

OSAKA, Japan, May 8, 2025 – Takeda (TSE:4502/NYSE:TAK) today announced financial results for fiscal year 2024 (period ended March 31, 2025) with continued strong momentum in Growth & Launch Products offsetting loss of exclusivity impact to drive revenue and Core Operating Profit growth, supported by robust cost management.

Takeda has built a high-value late-stage pipeline with potentially life-transforming new treatment options for patients. Following a positive Phase 3 readout for rusfertide in Oncology in March 2025, the company anticipates a further two Phase 3 readouts in core therapeutic areas this fiscal year.

FY2025 Management Guidance at CER reflects residual carry-over of VYVANSE® generic impact, continued efficiency savings and investment in R&D and launch preparation for Takeda’s late-stage pipeline.

Takeda chief executive officer, Christophe Weber, commented:“Takeda delivered excellent results in FY2024. Our return to Core Operating Profit margin growth underscores the strength of our Growth & Launch Products portfolio and the ability of our multi-year efficiency program to deliver meaningful cost savings.

“FY2025 will be a pivotal year as we invest in launch readiness for the late-stage pipeline, which will contribute to our broadly flat Core Operating Profit outlook for FY2025 but will be key to achieving Takeda’s long-term growth potential.”

Takeda chief financial officer, Milano Furuta, commented:“Takeda's success in delivering revenue and Core Operating Profit growth in FY2024 and our outlook for broadly flat revenue and profit in FY2025, demonstrates our ability to manage through one of the largest generic impacts on our business in Takeda’s history while progressing a highly promising late-stage pipeline. Our performance and outlook speak to the strength of our Growth & Launch Products, our innovative pipeline and the resilience of our organization as a whole.

“Takeda is now at an inflection point, with multiple anticipated Phase 3 data readouts this fiscal year, and I’m excited about our growth trajectory.”

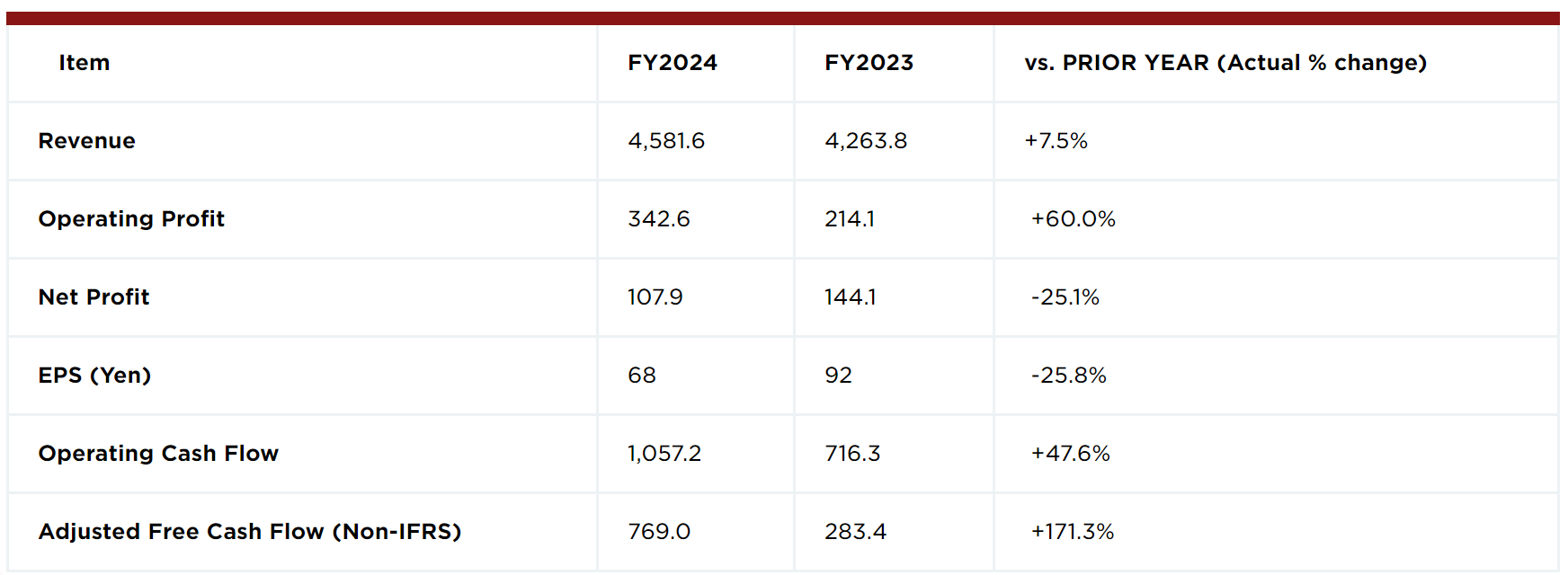

FINANCIAL HIGHLIGHTS for FY2024 Ended March 31, 2025

(Billion yen, except percentages and per share amounts)

Core (Non-IFRS)

(Billion yen, except percentages and per share amounts)

FY2025 Outlook

(Billion yen, except percentages and per share amounts)

Additional Information About Takeda’s FY2024 Results

For more details about Takeda’s FY2024 results, commercial progress, pipeline updates and other financial information, including key assumptions in the FY2025 forecast and management guidance as well as definitions of non-IFRS measures, please refer to Takeda’s FY2024 Q4 investor presentation (available at https://www.takeda.com/investors/financial-results/quarterly-results/)

About Takeda

Takeda is focused on creating better health for people and a brighter future for the world. We aim to discover and deliver life-transforming treatments in our core therapeutic and business areas, including gastrointestinal and inflammation, rare diseases, plasma-derived therapies, oncology, neuroscience and vaccines. Together with our partners, we aim to improve the patient experience and advance a new frontier of treatment options through our dynamic and diverse pipeline. As a leading values-based, R&D-driven biopharmaceutical company headquartered in Japan, we are guided by our commitment to patients, our people and the planet. Our employees in approximately 80 countries and regions are driven by our purpose and are grounded in the values that have defined us for more than two centuries.