Total Worldwide Sales Were $15.8 Billion, a Decrease of 2% From Second Quarter 2024 Both Nominally and Excluding the Impact of Foreign Exchange

KEYTRUDA Sales Were $8.0 Billion, Growth of 9% Both Nominally and Excluding the Impact of Foreign Exchange

WINREVAIR Sales Were $336 Million

Animal Health Sales Were $1.6 Billion, Growth of 11% Both Nominally and Excluding the Impact of Foreign Exchange

GARDASIL/GARDASIL 9 Sales Were $1.1 Billion, a Decline of 55% Both Nominally and Excluding the Impact of Foreign Exchange

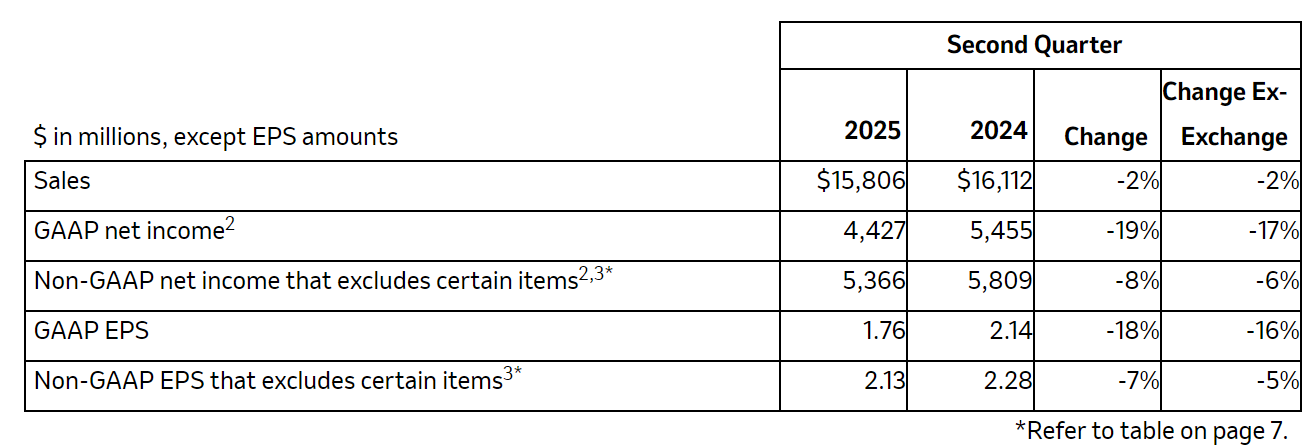

GAAP EPS Was $1.76; Non-GAAP EPS Was $2.13; GAAP and Non-GAAP EPS Include a Charge of $0.07 per Share for Closing of Hengrui Pharma License Agreement

Announced Agreement To Acquire Verona Pharma and Its First-In-Class COPD Maintenance Treatment for Adults, Ohtuvayre®;1 Transaction Expected To Close in Fourth Quarter 2025

Announced Positive Topline Results From First Two Phase 3 CORALreef Trials of Enlicitide Decanoate for Treatment of Adults With Hyperlipidemia

Received FDA Approval of ENFLONSIA for Prevention of RSV Lower Respiratory Tract Disease in Infants Born During or Entering Their First RSV Season; CDC’s ACIP Recommended ENFLONSIA for Prevention of RSV in Infants Younger Than 8 Months of Age for Their First RSV Season

Announced Multiyear Optimization Initiative Anticipated To Result in Approximately $3.0 Billion of Annual Cost Savings by the End of 2027, To Be Fully Reinvested Into Strategic Growth Areas

Full-Year 2025 Financial Outlook

Narrows Expected Worldwide Sales Range To Be Between $64.3 Billion and $65.3 Billion

Narrows Expected Non-GAAP EPS Range To Be Between $8.87 and $8.97

Outlook Does Not Include Anticipated Impact of the Announced Acquisition of Verona Pharma

July 29, 2025 -RAHWAY, N.J.--(BUSINESS WIRE)-- Merck & Co., Inc., Rahway, N.J., USA (NYSE: MRK), known as MSD outside the United States and Canada, today announced financial results for the second quarter of 2025.

"Earlier this month, we were pleased to announce our pending acquisition of Verona Pharma, which augments our portfolio and pipeline and is another example of acting decisively when science and value align,” said Robert M. Davis, chairman and chief executive officer. “Today, we announced a multiyear optimization initiative that will redirect investment and resources from more mature areas of our business to our burgeoning array of new growth drivers, further enable the transformation of our portfolio, and drive our next chapter of productive, innovation-driven growth. With these actions, I am confident that we are well positioned to generate near- and long-term value for our shareholders and, most importantly, deliver for our patients.”

Financial Summary

For the second quarter of 2025, Generally Accepted Accounting Principles (GAAP) earnings per share (EPS) assuming dilution was $1.76 and non-GAAP EPS was $2.13. GAAP and non-GAAP EPS in the second quarter of 2025 include a charge of $0.07 per share for an upfront payment to Jiangsu Hengrui Pharmaceuticals Co., Ltd. (Hengrui Pharma) upon closing of a license agreement. Non-GAAP EPS excludes acquisition- and divestiture-related costs, costs related to restructuring programs, and income and losses from investments in equity securities. Non-GAAP EPS in the second quarter of 2025 also excludes tax benefits primarily resulting from favorable audit adjustments. Non-GAAP EPS in the second quarter of 2024 also excludes a tax benefit due to a reduction in reserves for unrecognized income tax benefits, resulting from the expiration of the statute of limitations for assessments related to the 2019 federal tax return year.

Year-to-date results can be found in the attached tables.

New Multiyear Optimization Initiative, Which Includes a Restructuring Program

The Company launched a new multiyear optimization initiative to enable the transformation of its portfolio by generating an expected $3.0 billion in annual cost savings from productivity actions, which will be fully reinvested to support new product launches and its pipeline across multiple therapeutic areas.

In July 2025, as part of this initiative, the Company approved a new restructuring program, in which it expects to eliminate certain administrative, sales and R&D positions. The Company will, however, continue to hire employees into new roles across strategic growth areas of the business. In addition, the Company will reduce its global real estate footprint and continue to optimize its manufacturing network, aligning the geography of its global manufacturing to its customers and reflecting changes in the Company’s business.

The Company anticipates cumulative pretax costs related to the program to be approximately $3.0 billion. For the second quarter of 2025, the Company recorded charges in its GAAP results of $649 million related to this restructuring program.

The Company expects the actions under the restructuring program to result in annual cost savings of approximately $1.7 billion, which will be substantially realized by the end of 2027. This restructuring program is part of the multiyear optimization initiative expected to achieve $3.0 billion in annual cost savings by the end of 2027.

Manufacturing and R&D Investment

The Company continued to make long-term investments in its U.S. manufacturing and R&D capabilities. This includes the start of construction for a $1.0 billion, 470,000-square-foot state-of-the-art biologics center of excellence in Wilmington, Delaware, which will serve as a launch and commercial production facility and the primary U.S. manufacturing site for KEYTRUDA. In addition, the Company announced an $895 million expansion of its Animal Health manufacturing facility in De Soto, Kansas; the 200,000-square-foot facility will increase capacity for Animal Health vaccines and biologic products.

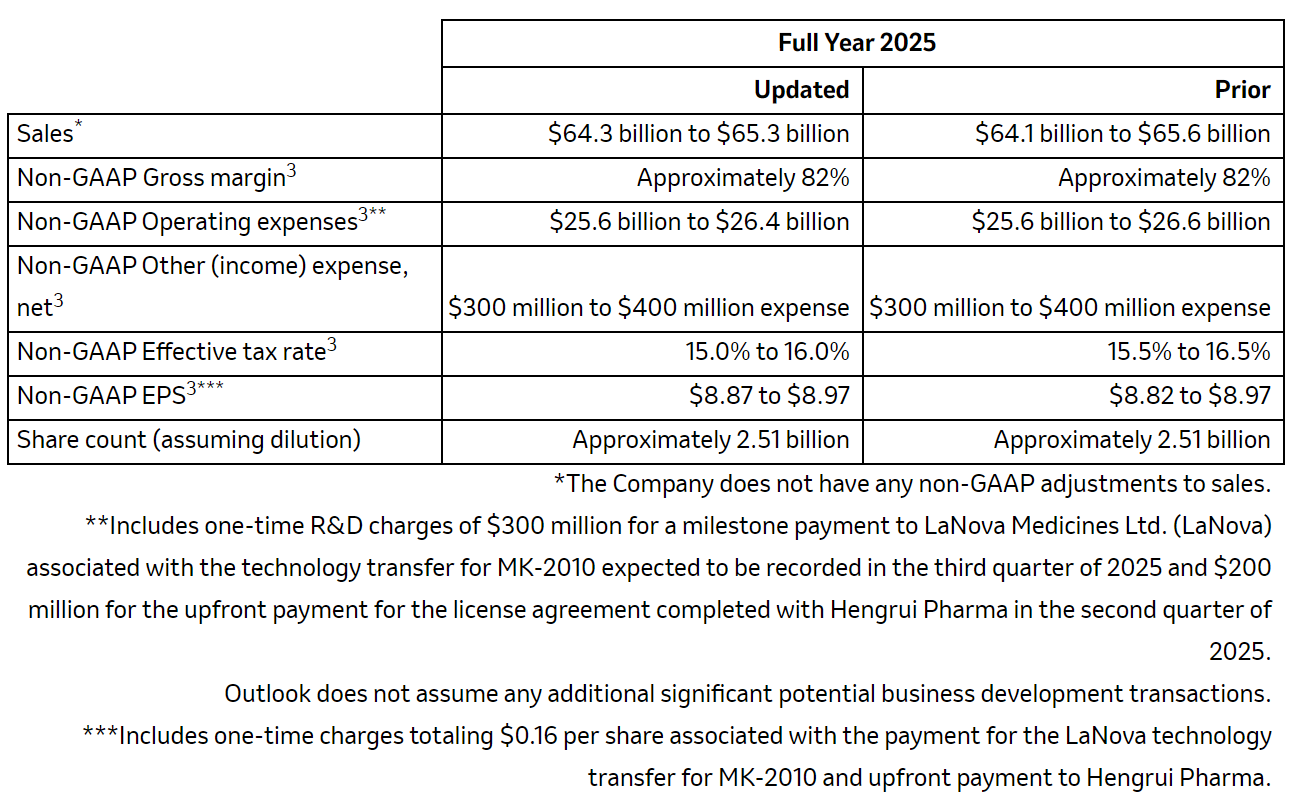

Full-Year 2025 Financial Outlook

The following table summarizes the Company’s full-year financial outlook.

The Company has not provided a reconciliation of forward-looking non-GAAP gross margin, non-GAAP operating expenses, non-GAAP other (income) expense, net, non-GAAP effective tax rate and non-GAAP EPS to the most directly comparable GAAP measures, given it cannot predict with reasonable certainty the amounts necessary for such a reconciliation, including intangible asset impairment charges, legal settlements, and income and losses from investments in equity securities either owned directly or through ownership interests in investment funds, without unreasonable effort. These items are inherently difficult to forecast and could have a significant impact on the Company’s future GAAP results.

The Company now expects full-year 2025 sales to be between $64.3 billion and $65.3 billion, including a revised negative impact of foreign exchange of approximately 0.5% at mid-July 2025 exchange rates.

The Company now expects its full-year non-GAAP effective income tax rate to be between 15.0% and 16.0%.

The Company now expects its full-year non-GAAP EPS to be between $8.87 and $8.97, including a revised negative impact of foreign exchange of approximately $0.15 per share. This revised non-GAAP EPS range continues to reflect the impacts of a one-time charge of $200 million (recorded in the second quarter of 2025) for an upfront payment made in connection with the closing of a license agreement with Hengrui Pharma and the one-time charge of $300 million (to be recorded in the third quarter of 2025) related to a payment to LaNova for the completion of the technology transfer for MK-2010, which will impact EPS by approximately $0.16 in the aggregate. In 2024, non-GAAP EPS of $7.65 was negatively impacted by a net charge of $1.28 per share related to certain asset acquisitions, licensing agreements and collaborations.

The financial outlook does not include the anticipated impact of the announced acquisition of Verona Pharma.

Consistent with past practice, the financial outlook does not assume additional significant potential business development transactions.

The $200 million of costs previously included in the Company’s financial outlook related to the impact of tariffs is unchanged pending the outcome of additional potential government actions.

Earnings Conference Call

Investors, journalists and the general public may access a live audio webcast of the call on Tuesday, July 29, at 9 a.m. ET via this weblink. A replay of the webcast, along with the sales and earnings news release, supplemental financial disclosures and slides highlighting the results, will be available on the Company’s website.

All participants may join the call by dialing (800) 369-3351 (U.S. and Canada Toll-Free) or (517) 308-9448 and using the access code 9818590.

About Our Company

At Merck & Co., Inc., Rahway, N.J., USA, known as MSD outside of the United States and Canada, we are unified around our purpose: We use the power of leading-edge science to save and improve lives around the world. For more than 130 years, we have brought hope to humanity through the development of important medicines and vaccines. We aspire to be the premier research-intensive biopharmaceutical company in the world – and today, we are at the forefront of research to deliver innovative health solutions that advance the prevention and treatment of diseases in people and animals. We foster a diverse and inclusive global workforce and operate responsibly every day to enable a safe, sustainable and healthy future for all people and communities.

1 All trademarks are property of their respective owners.

2 Net income attributable to the Company.

3 The Company is providing certain 2025 and 2024 non-GAAP information that excludes certain items because of the nature of these items and the impact they have on the analysis of underlying business performance and trends. Management believes that providing this information enhances investors’ understanding of the Company’s results because management uses non-GAAP results to assess performance. Management uses non-GAAP measures internally for planning and forecasting purposes and to measure the performance of the Company along with other metrics. In addition, annual employee compensation, including senior management’s compensation, is derived in part using a non-GAAP pretax income metric. This information should be considered in addition to, but not as a substitute for or superior to, information prepared in accordance with GAAP. For a description of the non-GAAP adjustments, see Table 2a attached to this release.

4 Reflects expenses related to business combinations, including the amortization of intangible assets, intangible asset impairment charges, and expense or income related to changes in the estimated fair value measurement of liabilities for contingent consideration. Also includes integration, transaction and certain other costs associated with acquisitions and divestitures, as well as amortization of intangible assets related to collaborations and licensing arrangements.

5 Includes the estimated tax impacts on the reconciling items based on applying the statutory rate of the originating territory of the non-GAAP adjustments for both periods presented. Amount in the second quarter of 2025 also includes a $146 million benefit primarily resulting from favorable audit adjustments. Amount in the second quarter of 2024 also includes a $259 million benefit due to a reduction in reserves for unrecognized income tax benefits resulting from the expiration of the statute of limitations for assessments related to the 2019 federal tax return year.