-

Product Sales Excluding Veklury Increased 4% Year-Over-Year to $7.1 billion

-

Biktarvy Sales Increased 6% Year-Over-Year to $3.7 billion

October 30, 2025--FOSTER CITY, Calif.--(BUSINESS WIRE)-- Gilead Sciences, Inc. (Nasdaq: GILD) announced today its third quarter 2025 results of operations.

“We continue to deliver on Gilead's robust portfolio with a strong start for Yeztugo, rapidly growing uptake of Biktarvy, Descovy and Livdelzi, and positive data for Trodelvy in 1L metastatic triple negative breast cancer,” said Daniel O’Day, Gilead’s Chairman and Chief Executive Officer. “With multiple potential product launches in 2026, the strongest clinical pipeline in Gilead’s history, and no major loss of exclusivity expected until 2036, we are well-positioned to drive positive impact for patients and continued growth of our business.”

Third Quarter 2025 Financial Results

Total third quarter 2025 revenues increased 3% to $7.8 billion compared to the same period in 2024, broken down as follows:

-

Total third quarter 2025 product sales decreased 2% to $7.3 billion compared to the same period in 2024, primarily driven by lower Veklury® (remdesivir) and Cell Therapy sales, partially offset by higher HIV and Livdelzi® (seladelpar) sales.

-

Total third quarter 2025 royalty, contract and other revenues increased by approximately $400 million compared to the same period in 2024, primarily driven by revenue related to a previous sale of intellectual property not expected to reoccur.

Diluted earnings per share (“EPS”) was $2.43 in the third quarter 2025 compared to $1.00 in the same period in 2024. The increase was primarily driven by a prior year pre-tax in-process research and development (“IPR&D”) impairment charge of $1.75 billion that did not repeat in the current period, as well as the $400 million increase in other revenue mentioned above, lower acquired IPR&D expenses and higher net unrealized gains on equity investments in the current period, partially offset by higher tax expense.

Non-GAAP diluted EPS of $2.47 in the third quarter 2025 compared to $2.02 in the same period in 2024. The increase was primarily driven by the $400 million increase in other revenue mentioned above and lower acquired IPR&D expenses.

As of September 30, 2025, Gilead had $9.4 billion of cash, cash equivalents and marketable debt securities compared to $10.0 billion as of December 31, 2024.

During the third quarter 2025, Gilead generated $4.1 billion in operating cash flow.

During the third quarter 2025, Gilead paid dividends of $1.0 billion and repurchased $435 million of common stock.

Third Quarter 2025 Product Sales

Total third quarter 2025 product sales decreased 2% to $7.3 billion compared to the same period in 2024. Total third quarter 2025 product sales excluding Veklury increased 4% to $7.1 billion compared to the same period in 2024, primarily due to higher HIV and Livdelzi sales, partially offset by lower Cell Therapy sales.

HIV product sales increased 4% to $5.3 billion in the third quarter 2025 compared to the same period in 2024, primarily driven by higher demand and favorable inventory dynamics, partially offset by lower average realized price.

-

Biktarvy®(bictegravir 50mg/emtricitabine (“FTC”) 200mg/tenofovir alafenamide (“TAF”) 25mg) sales increased 6% to $3.7 billion in the third quarter 2025 compared to the same period in 2024, primarily driven by higher demand and favorable inventory dynamics, partially offset by lower average realized price.

-

Descovy®(FTC 200mg/TAF 25mg) sales increased 20% to $701 million in the third quarter 2025 compared to the same period in 2024, primarily driven by higher demand.

The Liver Disease portfolio sales increased 12% to $819 million in the third quarter 2025 compared to the same period in 2024, primarily driven by higher demand for Livdelzi.

Veklury sales decreased 60% to $277 million in the third quarter 2025 compared to the same period in 2024, primarily driven by lower rates of COVID-19-related hospitalizations.

Cell Therapy product sales decreased 11% to $432 million in the third quarter 2025 compared to the same period in 2024, reflecting ongoing competitive headwinds.

-

Yescarta® (axicabtagene ciloleucel) sales decreased 10% to $349 million in the third quarter 2025 compared to the same period in 2024, primarily driven by lower demand.

-

Tecartus® (brexucabtagene autoleucel) sales decreased 15% to $83 million in the third quarter 2025 compared to the same period in 2024, primarily reflecting lower demand.

Trodelvy® (sacituzumab govitecan-hziy) sales increased 7% to $357 million in the third quarter 2025 compared to the same period in 2024, primarily driven by higher demand.

Third Quarter 2025 Product Gross Margin, Operating Expenses and Effective Tax Rate

-

Product gross margin remained relatively flat at 78.6% in the third quarter 2025 compared to 79.1% in the same period in 2024. Non-GAAP product gross margin also remained relatively flat at 86.5% in the third quarter 2025 compared to 86.8% in the same period in 2024.

-

Research and development (“R&D”) expenses and non-GAAP R&D expenses were $1.3 billion in the third quarter 2025 compared to $1.4 billion in the same period in 2024, decreasing primarily due to lower study-related and clinical manufacturing expenses.

-

Acquired IPR&D expenses were $170 million in the third quarter 2025, primarily related to a $120 million upfront payment related to our collaboration with Shenzhen Pregene Biopharma Co., Ltd. (“Pregene”).

-

Selling, general and administrative (“SG&A”) expenses and non-GAAP SG&A expenses of $1.4 billion in the third quarter 2025 remained relatively flat compared to the same period in 2024, with lower corporate expenses being largely offset by higher HIV promotional expenses.

-

The effective tax rate (“ETR”) was 16.2% in the third quarter 2025 compared to (31.1)% in the same period in 2024, primarily driven by the prior year impact of a legal entity restructuring and the aforementioned IPR&D impairment charge that did not repeat in the current period. The non-GAAP ETR was 17.5% in both the third quarter 2025 and the same period in 2024.

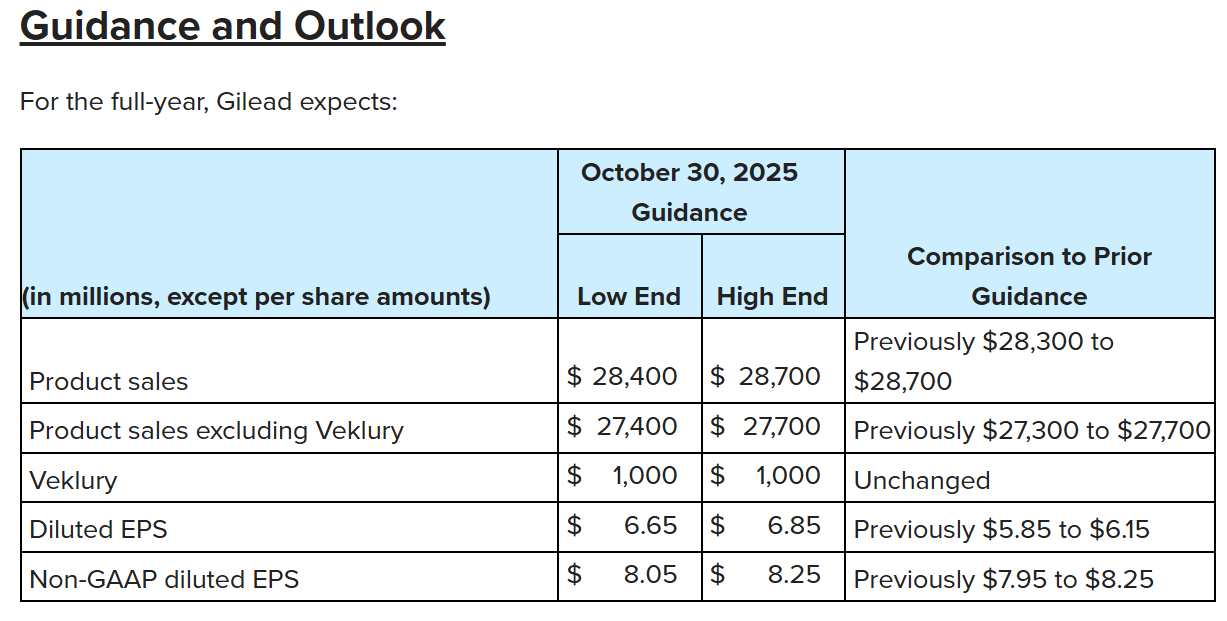

Additional information and a reconciliation between GAAP and non-GAAP financial information for the 2025 guidance is provided in the accompanying tables. The financial guidance is subject to a number of risks and uncertainties. See the Forward-Looking Statements section below.

Key Updates Since Our Last Quarterly Release

Virology

Announced settlement agreements to resolve Biktarvy patent litigation with generic manufacturers Lupin Ltd., Cipla Ltd. and Laurus Labs Ltd. Under the agreements, the earliest date the three generic manufacturers can market a generic version of full dose Biktarvy in the U.S. is April 1, 2036, subject to standard acceleration provisions. This is more than two years later than our previous loss of exclusivity projection for Biktarvy (December 2033).

Received a strong recommendation for the use of twice-yearly injectable Yeztugo® (lenacapavir) for HIV pre-exposure prophylaxis (“PrEP”) in the new U.S. Centers for Disease Control and Prevention guidelines.

Announced a partnership with the U.S. State Department and the U.S. President’s Emergency Plan for AIDS Relief (“PEPFAR”) to deliver lenacapavir for HIV PrEP for up to two million people over three years in countries supported by both PEPFAR and the Global Fund.

Received European Commission marketing authorization for Yeytuo® (lenacapavir) for use as PrEP to reduce the risk of sexually acquired HIV-1 in adults and adolescents with increased HIV-1 acquisition risk.

Oncology

Presented Phase 3 ASCENT-03 data for Trodelvy® in 1L metastatic triple-negative breast cancer (“mTNBC”) patients who are not candidates for PD-1/PD-L1 checkpoint inhibitors at the 2025 European Society for Medical Oncology (“ESMO”) Congress. Trodelvy is not approved in this setting.

Presented overall survival results at ESMO from Arm A1 of the Phase 2 EDGE-Gastric study evaluating combination treatment of the Fc-silent anti-TIGIT domvanalimab plus the anti-PD-1 zimberelimab and chemo in people with advanced gastric or esophageal cancer that has spread or cannot be removed with surgery. Domvanalimab and zimberelimab are investigational and not approved in this setting.

Cell Therapy

Announced the acquisition of Interius BioTherapeutics, Inc. (“Interius”), a privately held biotechnology company developing in vivo therapeutics.

Corporate

The Board declared a quarterly dividend of $0.79 per share of common stock for the fourth quarter of 2025. The dividend is payable on December 30, 2025, to stockholders of record at the close of business on December 15, 2025. Future dividends will be subject to Board approval.

Moody’s has affirmed Gilead’s A3 senior unsecured rating and upgraded the company’s outlook to positive from stable, citing the momentum in the product pipeline.

Announced ground-breaking on a new Pharmaceutical Development and Manufacturing Technical Development Center in Foster City, California as part of a planned $32 billion investment in the U.S. through 2030.

Certain amounts and percentages in this press release may not sum or recalculate due to rounding.

Non-GAAP Financial Information

The information presented in this document has been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), unless otherwise noted as non-GAAP. Management believes non-GAAP information is useful for investors, when considered in conjunction with Gilead’s GAAP financial information, because management uses such information internally for its operating, budgeting and financial planning purposes. Non-GAAP information is not prepared under a comprehensive set of accounting rules and should only be used to supplement an understanding of Gilead’s operating results as reported under GAAP. Non-GAAP financial information generally excludes acquisition-related expenses including amortization of acquired intangible assets and other items that are considered unusual or not representative of underlying trends of Gilead’s business, fair value adjustments of equity securities and discrete and related tax charges or benefits associated with such exclusions as well as changes in tax-related laws and guidelines, transfers of intangible assets between certain legal entities, and legal entity restructurings. Although Gilead consistently excludes the amortization of acquired intangible assets from the non-GAAP financial information, management believes that it is important for investors to understand that such intangible assets were recorded as part of acquisitions and contribute to ongoing revenue generation. Non-GAAP measures may be defined and calculated differently by other companies in the same industry. Reconciliations of the non-GAAP financial measures to the most directly comparable GAAP financial measures are provided in the accompanying tables.

About Gilead Sciences

Gilead Sciences, Inc. is a biopharmaceutical company that has pursued and achieved breakthroughs in medicine for more than three decades, with the goal of creating a healthier world for all people. The company is committed to advancing innovative medicines to prevent and treat life-threatening diseases, including HIV, viral hepatitis, COVID-19, cancer and inflammation. Gilead operates in more than 35 countries worldwide, with headquarters in Foster City, California.